About the Roland George Investments Program

Objective

The students in the Roland George Investments Program develop their own investment goals, objectives and criteria for managing a portfolio of $7.4 million. They function as an investment management firm would, where a complete investment policy is established and revised as needed. Individual security selections are researched using fundamental tools such as Bloomberg.

The students must defend their recommendations to the other students and an investments committee, dominated by students that function much as the senior strategy group of an investment management firm. Their goal is to earn a return that funds the acquisition of special systems and software for the program, as well as to meet operating expenses.

Mission

The Roland and Sarah George Investments Program was established at Stetson University through a gift made in 1980 by Mrs. Sarah George.

This innovative program was designed to

- Honor Mr. Roland George by implementing his belief that students learn best through actual experience in making investment decisions.

- Provide advanced courses in investments to the School of Business Administration

- Establish two investment funds, one income oriented and the other growth oriented

- Generate sufficient income to:

- Maintain the Roland George Chair of Applied Investments

- Maintain the Roland George Merit Award program designated for outstanding students seeking careers in investments

- Purchase resource materials to support the courses

- Administer the overall program

On behalf of all of the program's participants - past, present and future - we would like to express our appreciation to Mrs. Sarah George for making this valuable opportunity possible.

History

On August 20, 1980, assets with a value of nearly $500,000 were transferred to Stetson University. This gift fulfilled the dream of the late Mr. Roland George, who believed students should learn from hands-on experience. His vision allows Stetson University to offer students an opportunity that few other institutions of higher education can - the investment and management of actual dollars.

On August 20, 1980, assets with a value of nearly $500,000 were transferred to Stetson University. This gift fulfilled the dream of the late Mr. Roland George, who believed students should learn from hands-on experience. His vision allows Stetson University to offer students an opportunity that few other institutions of higher education can - the investment and management of actual dollars.

In honor of her husband, Mrs. Sarah George sought a university that would allow students to manage money under the guidance of successful practitioners. Because Mr. George was annoyed with colleges teaching only theory, the program he envisioned would enable students to manage an actual portfolio. Under the pressure of generating sufficient income to pay program expenses, the students would purchase and sell securities and monitor the portfolio. Mrs. George stressed that failure, as well as success, should be part of the learning experience and insisted that students have a major voice in the investment decision-making process.

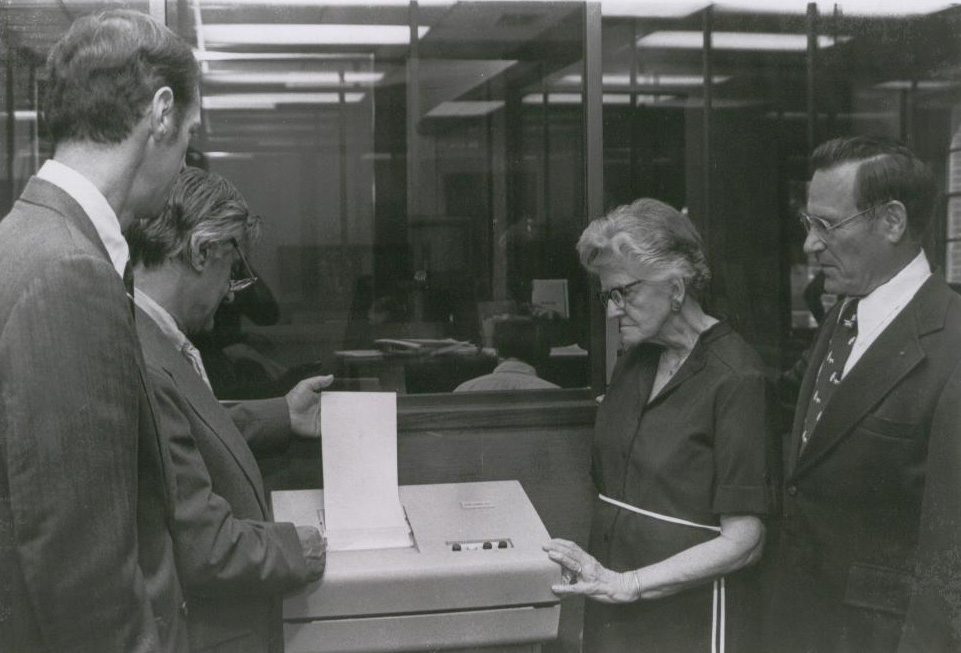

Mrs. George, along with her brother Robert Wilson and attorney Frank Gaylord, approached Stetson University with her idea. Their contributions, with those of President Pope Duncan, Dean David Nylen, Dr. H. Douglas Lee and Professor Kenneth Jackson, developed the Roland George Investments Program.

Stetson University's Roland George Investments Program is unique in its conception and design. Stetson business students are afforded the opportunity to manage a portfolio, complete with the pressures of possible failure. While many universities offer courses using computer-simulated programs with "play" money, Stetson University students are charged with investing $3.5 million.

Mr. Roland George felt that exposing students to experienced investment managers and allowing them to participate in actual investment decisions were ideal ways to prepare for a career in investments. His dream has become a reality, and the program has met its goals successfully for 38 years.