Candidates Tackle College Affordability

by Michael Candelaria

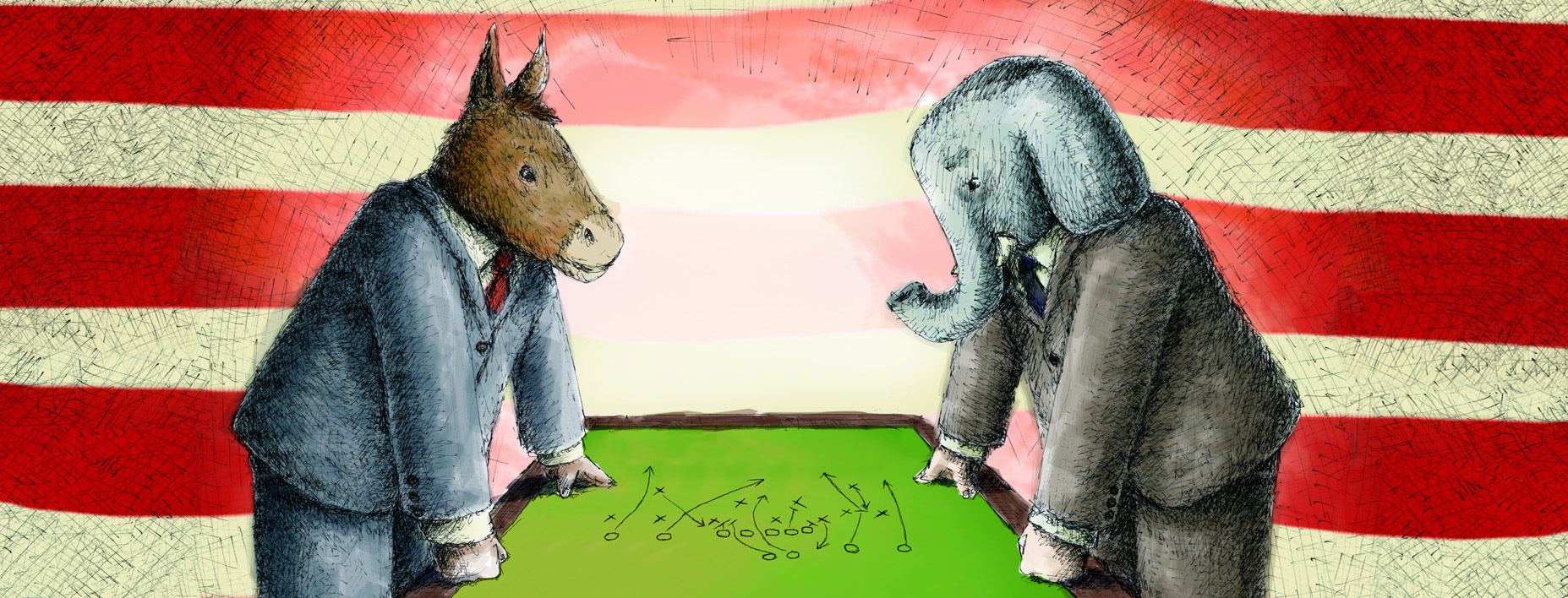

As college football teams are putting on their shoulder pads and returning to the gridiron, football of another sort has been playing out in Washington, D.C., for months. Call it political football, complete with plenty of passes, punts and end runs— all centered on college affordability or, more precisely, the idea of free college.

Politicians have drawn their Xs and Os on the chalkboard, with an eye toward big wins in their future. Nonpartisan lobbying and advocacy groups have cheered; others have jeered. Meanwhile, university administrators and educators are watching with the keen interest of concerned but faithful fans.

As the heat rises on campaigns for public office — including the United States presidency — anticipation is growing greater than the buzz of a season opener between rivals. The burning question: What to do with the issue of college affordability?

In light of the current field conditions, yet another question lingers: Is there an even better game plan for the players who matter most — students and their families?

The Field

Indeed, the 2016 Democratic presidential primary essentially has begun, with the cost of college squarely under debate. In January, President Barack Obama outlined a plan for free community college, initiating this most recent round of national conversations about affordability. That move was followed by opinions, proposals and resolutions from, among others, Sen. Bernie Sanders (I-Vt), Sen. Elizabeth Warren (D-Mass.), former Secretary of State Hillary Clinton, and Democrat Martin O’Malley, former governor of Maryland.

Sanders introduced legislation in May designed to eliminate tuition for undergraduates at all public colleges and universities. His plan requires the federal government (meaning taxpayers) to pay the lion’s share of the estimated $70 billion in annual tuition costs at those institutions, with states paying the remainder.

Sanders introduced legislation in May designed to eliminate tuition for undergraduates at all public colleges and universities. His plan requires the federal government (meaning taxpayers) to pay the lion’s share of the estimated $70 billion in annual tuition costs at those institutions, with states paying the remainder.

Warren believes colleges should share in the risk associated with student loans by encouraging colleges to take action to prevent defaults like keeping costs down and supporting at-risk students, among other measures.

Clinton’s sweeping, $350 billion plan (over 10 years) walks a line between Sanders’ free tuition proposal and O’Malley’s debt-free ideas. Clinton proposes to push states to spend more on higher education and allow those with student loans to refinance at a lower rate among other things.

Their collective message: Reducing or eliminating students’ financial burden of higher education is a national priority. Not coincidentally, each of them harbors hope of standing on stage to close the 2016 Democratic National Convention next July in Philadelphia.

For their part, Republicans have largely played prevent defense — refraining, for now, from blitzing their opponents.

Other proposals on the table would simplify the Free Application for Federal Student Aid (FAFSA), which typically asks 108 questions but can include as many as 136. Those include a proposal from the National Association of Student Financial Aid Administrators (NASFAA), which acknowledges that the application is overly complex.

The Fans

Responses from the sidelines have been mixed. Few people in and around higher education doubt the importance of the topic or the need to do something about affordability, but details are sparse for existing ideas.

“I think it’s a novel idea and could become a very good idea, but I am cautious,” says Michelle Cooper of Sanders’ idea to eliminate tuition. Cooper is president of the Washington, D.C.-based Institute for Higher Education Policy, a nonpartisan, nonprofit organization that promotes access to higher education for all.

“Free college isn’t really free because somebody has to pay, like American taxpayers,” Cooper says, adding that she awaits more details on these proposals from the presidential candidates.

“The ideas are very different, and for the most part they’re not clearly sketched out,” says Terry Hartle, senior vice president of government and public affairs at the American Council on Education, a nonpartisan policy and lobbying group for colleges and universities in Washington, D.C. Hartle acknowledges that affordability and student indebtedness are “grave” concerns across the nation. However, a precise plan has yet to emerge, he says.

Among his questions: Which students are to benefit? Which schools will be eligible? And how do the federal and state governments factor into the equation?

For the record, Cooper would like to see any solution involve institutional leaders working together to address the cost of college and finding new operational efficiencies on campus. Also, she advocates firming up existing public/private partnerships plus creating new ones, such as corporations funding scholarships, to help students.

Hartle believes solutions hinge on the federal government continuing its massive contributions toward financial aid and states reversing their current trend of diminishing dollars.

“States have steadily reduced their operating support and let tuitions go up to make up the difference,” says Hartle. “The federal government puts in more money than all states combined, which was not the case a decade ago. States must play the role they’ve historically played.”

One proposed solution even involves a lottery. New Jersey Assemblyman John Burzichelli (D-Cumberland/Gloucester/Salem) has introduced legislation that would make New Jersey the first state to establish a lottery to pay off student loans. Under the legislation, a private company under contract with the state could operate the lottery, and the New Jersey Lottery Commission would conduct the drawings. To play, past and present students would be required to register information about their loan.

Although the legislation has been introduced, attracting some interest from potential commercial partners, Burzichelli acknowledges the plan’s specifics must still be ironed out.

Such concessions ring true across the nation. Plans are being proposed, but they aren’t necessarily ready-made solutions.

The Financial Playbook

In the meantime, while political scenes play out and solutions are punted around, what can students and parents do to help themselves?

Susan Merchant, Stetson University’s director of Financial Aid, advocates education efficiency. “Use your time as a student wisely,” she says. “Completing your degree in four years instead of five or more will save you money.”

Another idea: When it comes to paying for college, while there is help available and perhaps more on the horizon, begin the process by taking matters into your own hands.

Another idea: When it comes to paying for college, while there is help available and perhaps more on the horizon, begin the process by taking matters into your own hands.

“Start saving right away,” Merchant says. She points to savings plans like the Private College 529 Plan, where earnings on contributions aren’t taxable, nor are withdrawals to pay for qualified higher education expenses. Also, unlike state plans, location of the college or university isn’t restricted, enhancing their popularity. Nationwide last year, assets in the plans increased 9.1 percent to $249.7 billion, according to College Savings Plan Network.

Aside from planning early, financial-aid packages based on need are potential answers. First, however, students and their families must study up, Merchant advises. Her tips for getting help begin with a review of college websites for specific requirements. “Find out exactly which documents are needed,” she says.

In addition, learn about the Net Price Calculator, a tool all colleges and universities are mandated to include on their websites, Merchant says. It’s also available from the U.S. Department of Education. The net price is the amount a student pays to attend an institution in a single academic year after subtracting scholarships and grants the student receives. Scholarships and grants are forms of financial aid that a student does not have to pay back.

Also, visit Federal Student Aid, says Merchant. A part of the U.S. Department of Education, it is the nation’s largest provider of student financial aid, with more than $150 billion in federal grants, loans and work-study funds going to more than 13 million students annually.

A chief step in receiving that financial aid is completing a FAFSA — a Free Application for Federal Student Aid. According to FAFSA, the final date to submit the application for the 2015-2016 academic year is June 30, 2016. However, if the results are received after the school year ends then the school can no longer process the aid, so it’s better to file well before that deadline. Also, many states and institutions use FAFSA data to determine eligibility for state and school aid, and some private financial aid providers use FAFSA information to determine qualification for their aid. To estimate federal student aid eligibility, use the FAFSA4caster , Merchant notes.

In much the same way, Stetson’s Office of Student Financial Planning features a four-year planning tool online. Students can use this estimator to figure out the number of units (each equal to four credit hours) needed and related costs per semester. For example, students need to complete at least eight units per academic year for most degree programs in order to graduate in four years. They need a minimum of three units in a semester to be considered a full-time student and cannot take more than 4.5 units in a single semester without special permission.

Bob Huth, CFO and executive vice president at Stetson, adds concluding advice: Think value.

“A college education is an investment in one’s life,” Huth says. “How great a return on that investment depends on the person. But there is no denying that a college education creates a foundation for the future in so many ways,” says Huth, a board member of the Tuition Plan Consortium, a not-for-profit organization formed in 1998 to establish a prepaid tuition 529 option designed specifically for private colleges and universities.

As debates continue up and down the field about “affordability” and “free,” perhaps that bit of guidance is also worth saving.